Strategic Legal Framework of the Institute

The Overarching Philosophy: The Trust as the Strategic Holding & Guiding Body

The ‘Padmavati Charitable Trust’ will act as the supreme, non-profit umbrella organization. Its primary role is not to run day-to-day operations but to:

- Hold Assets: Own the land, building, and other significant capital assets used by the institute.

- Set Vision & Mission: Ensure all entities operate in line with the charitable objective of promoting education.

- Receive Donations & Grants: As a charitable trust, it can receive funds, which can be channeled to the institute as grants.

- Own the Brand: Be the ultimate owner of the “Padmavati Institute of Event Management” brand.

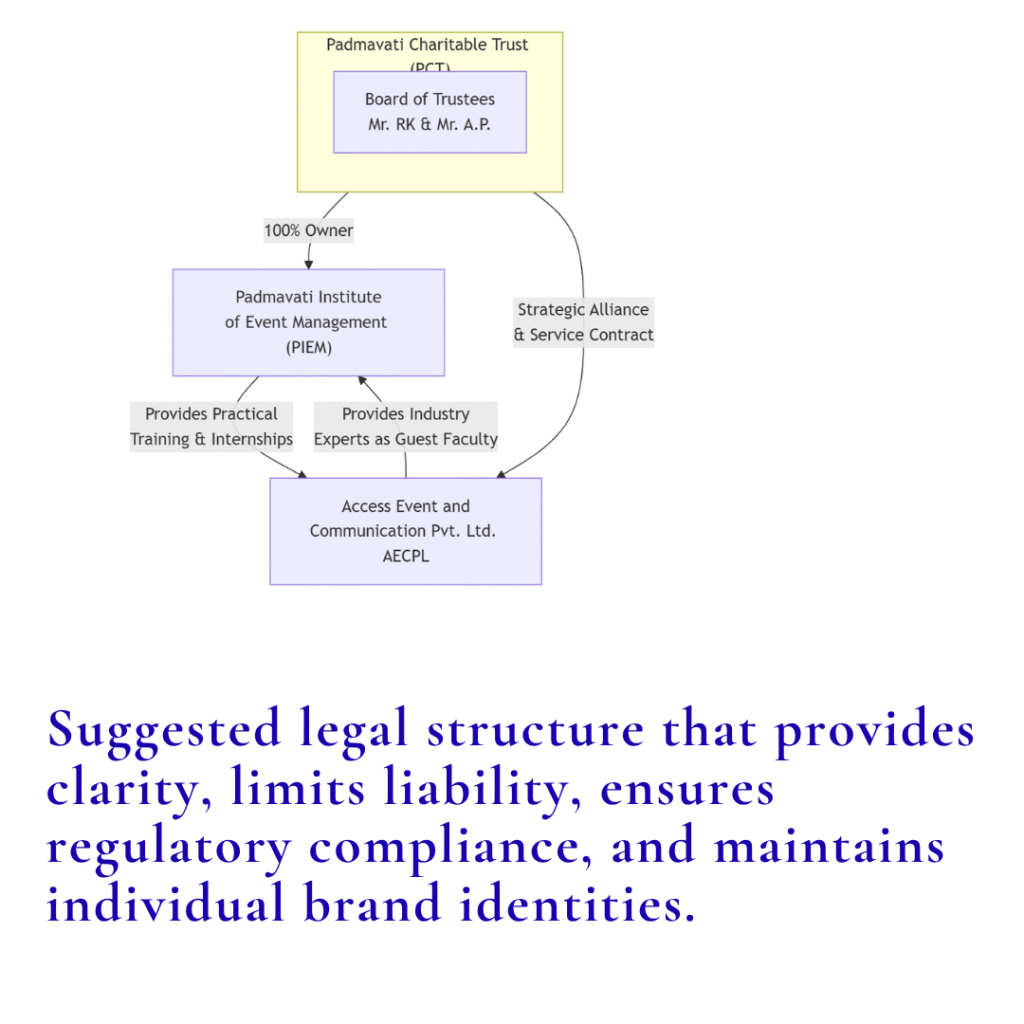

The Proposed Legal Structure

The structure can be visualized as follows:

1. The Educational Arm: “Padmavati Institute of Event Management” (PIEM)

This is the core charitable activity of the Trust. It should not be a separate company, but a project or unit of the Trust itself.

- Legal Identity: It operates under the registration and PAN of the Padmavati Charitable Trust. It does not have a separate legal identity, which simplifies compliance for its non-profit educational operations.

- Governing Body: A Governing Council or Board of Studies should be formed. This council will include:

- Mr. R.K. and Mr. A.P. as Trustees.

- Renowned academicians in event management, hospitality, or business.

- An industry representative (could be from AECPL in an advisory, non-voting capacity to avoid conflict of interest).

- Regulatory Compliance:

- Affiliation: If we plan to offer diplomas or degrees, we must affiliate with a University (under UGC) or the respective State Education Board.

- Certification Route: A simpler alternative is to offer certified courses. For this, you should seek accreditation from a reputed, government-recognized skill development body like the Tourism & Hospitality Skill Council (THSC) or Sector Skill Council (SSC) under the National Skill Development Corporation (NSDC). This gives the certification national credibility without the complexity of university affiliation.

- Funding: The institute will be funded by:

- Student fees (which must be reasonable and re-invested into the institute as it’s a charitable activity).

- Grants from the Trust (which the Trust receives as donations).

- Specific grants for skill development from government schemes.

2. The Commercial Arm: Access Event and Communication Pvt. Ltd. (AECPL)

This is your existing for-profit commercial entity. It must maintain its separate legal identity as a Private Limited Company.

- Legal Identity: Remains a separate Private Limited Company with its own Directors, PAN, and compliance requirements under the Companies Act, 2013.

- Relationship with the Trust & Institute:

- Arms-Length Transactions: All dealings between AECPL and the Trust/PIEM must be conducted at “arm’s length.” This means formal contracts, fair market value payments, and proper documentation. This is critical to preserve the charitable nature of the Trust and comply with tax laws.

- Service Provider: AECPL can enter into a formal Service Agreement with the Trust to provide the following services to the Institute:

- Practical Training & Internships: Provide students with hands-on experience at real events.

- Infrastructure Support: Provide event equipment (sound, lighting, etc.) on a rental basis.

- Guest Faculty: AECPL’s experts can be hired as guest lecturers for a honorarium.

- CSR Partner: As a Private Limited Company, AECPL may have Corporate Social Responsibility (CSR) obligations under the Companies Act. It can donate a portion of its CSR funds to the Padmavati Charitable Trust for the specific purpose of running the institute, as education is a recognized CSR activity. This creates a formal, legal channel for funding.

3. The Role of the Trust in Coordinating the Structure

The Trust is the linchpin that holds everything together.

- Brand Licensing: The Trust can grant a formal license to the “Padmavati Institute of Event Management” to use its name. For AECPL, the relationship is purely commercial, and it should continue to use its own brand.

- Asset Ownership & Usage: The Trust owns the campus. It can allow the institute to use it for free (as its own project). It can lease/rent out parts of the infrastructure (e.g., auditoriums, grounds) to AECPL for its events or for student training at a fair market rent, governed by a formal contract.

- Avoiding Conflict of Interest: As Trustees of a charitable organization and Directors of a for-profit company, Mr. R.K. and Mr. A.P. must always ensure that decisions are made in the best interest of the entity they are acting for at that moment. All transactions between the Trust and the Company must be transparent, justified, and at arm’s length.

Summary of Advantages of This Structure:

- Clarity of Purpose: Clean separation of non-profit education and commercial business.

- Limited Liability: The commercial risks of AECPL do not affect the Trust’s assets, and vice-versa.

- Tax Efficiency: The Trust and its institute can claim tax exemptions under Sections 11 and 12 of the Income Tax Act for their charitable educational activities. AECPL continues to be taxed as a corporate entity.

- Regulatory Compliance: The structure is designed to meet the requirements of the Trusts Act, Companies Act, and potentially, UGC/NSDC norms.

- Synergy: Creates a powerful loop: AECPL gets a skilled workforce from the institute, and the institute gets real-world training and industry exposure from AECPL.

- Brand Value: The “Padmavati” brand gains prestige through education, which can indirectly benefit AECPL’s reputation.

Immediate Next Steps:

- Draft a Trust Deed Amendment: If required, explicitly include “to establish and run educational institutions” as a key objective of the Padmavati Charitable Trust.

- Constitute the Governing Council: For the institute with independent members.

- Formalize Contracts: Draft the Service Agreement between the Trust and AECPL, and a Asset Use/License Agreement.

- Initiate Affiliation/Accreditation: Start the process with a university or a skill council like THSC.

READ MORE ABOUT ‘The Core Principle: Stackable Credentials’

1 Response

[…] Strategic Legal Framework of the Institute […]